| Figure 4.1.a - Standard #4 Measurement and Analysis of Student Learning and Performance_Financial Management |

| Use this table to supply data for Criterion 4.1. - Financial Management - CITBS |

| Performance Indicator |

You must provide assessments results for each program, concentration, specialization, etc. accredited or to be accredited. You must have direct, summative, formative and comparative results. |

| 1. Student Learning Results |

A student learning outcome is one that measures a specific competency attainment. Examples of a direct assessment (evidence) of student learning attainment that might be used include: capstone performance, third-party examination, faculty-designed examination, professional performance, licensure examination). Add these to the description of the measurement instrument in column two:

Direct - Assessing student performance by examining samples of student work

Indirect - Assessing indicators other than student work such as getting feedback from the student or other persons who may provide relevant information.

Formative – An assessment conducted during the student’s education.

Summative – An assessment conducted at the end of the student’s education.

Internal – An assessment instrument that was developed within the business unit.

External – An assessment instrument that was developed outside the business unit.

Comparative – Compare results to external students using data from the U.S. Department of Education Research and Statistics, or results from a vendor providing comparable data. Internal comparative data may be between classes, online and on ground classes, professors, programs, campuses, etc.

|

|

Analysis of Results |

|

| Identified in Criterion 4.2 |

Identified in Criterion 4.1 |

Identified in Criterion 4.3 |

Identified in Criterion 4.4 |

Identified in Criterion 4.3 |

| Approach |

Deployment (Do not use grades or GPA) |

Results |

Analysis of Results |

Improvement Action Taken or Improvement made |

Insert Graphs or Tables of Trends (3-5 data points) Report sample or population size n = # |

| Learning objectives SLO1, SLO2, etc. |

What is your measurement instrument or process? |

What are your current results? |

What did you learn from the results? |

What did you improve or what is your next step? |

|

| Measurable Goals 80%, 5.5 or above, etc. |

(Indicate type of instrument) direct, formative, internal, comparative |

|

|

|

|

| Financial Management |

|

|

|

|

|

SLO3 - Students will demonstrate the ability to use analytical and critical thinking skills to evaluate integrated analysis and research.

Performance Criteria - At least 60% of student enrolled in Financial Management courses in the Financial Management program are scoring at or above qualified level on the final comprehensive exam.

100-point scale used: Exemplary(90-100), Superior(80-90), Proficient(70-80), Qualified(60-70) and Inadequate(below 60). |

Direct, Summative, Internal |

Student Population: Data of 8 classes of Financial Mangement Program were collected for 3 cycles, academic years: 2018/2019, 2019/2020, 2020/2021 following

our accreditation process.

The performance criteria were as follows:

Class0204171 (71.43%), Class0204172 (42.85%) and Class0204173 (45%) in 2018/2019.

Class0204172 (35.71%), Class0204181 (61.90%), Class0204182 (55%) and Class0204183 (61.36%) in 2019/2020.

Class0204181 (75%), Class0204183 (54.54%), Class0204191 (71.04%) and Class0204192 (65.85%) in 2020/2021. |

The performance criteria was met by 6 classes in 3 academic years: Class0204171 (71.43%) in 2018/2019, Class0204181 (61.90%) and Class0204183 (61.36%) in 2019/2020, and Class0204181 (75%), Class0204191 (71.04%) and Class0204192 (65.85%) in 2020/2021.

We didn't met the criteria for Class0204172 (42.85%) and Class0204173 (45%) in 2018/2019, Class0204172 (35.71%) and Class0204182 (55%) in 2019/2020, Class0204183 (54.54%) in 2020/2021. |

We made steady progress as the 3 out of 4 classes in 2020/2021 achieved the performance goal while it was only 2 out of 4 achieved the goal in 2019/2020, and the ratio of qualified student has significantly increased.

We increaseed the case analysis. Analyzed the real Financial Statements of the listed companies in the cases, improved students' analytical and critical thinking skills. |

|

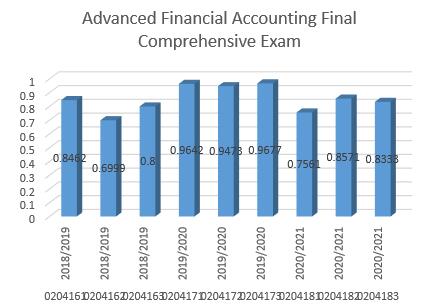

SLO4 - Students will demonstrate the ability to use analytical and critical thinking skills to evaluate countermeasures and solutions.

Performance Criteria - At least 80% of student enrolled in Advanced Financial Accounting courses in the Financial Management program are scoring at or above qualified level on the final comprehensive exam.

100-point scale used: Exemplary(90-100), Superior(80-90), Proficient(70-80), qualified(60-70) and Inadequate(below 60). |

Direct, Summative, Internal |

Student Population: Data of 9 classes of Financial Mangement Program were collected for 3 cycles, academic years: 2018/2019, 2019/2020, 2020/2021 following

our accreditation process.

The performance criteria were as follows:

Class0204161 (84.62%), Class0204162 (69.99%) and Class0204163 (80%) in 2018/2019.

Class0204171 (96.42%), Class0204172 (94.73%), and Class0204173 (96.77%) in 2019/2020.

Class0204181 (75.61%), Class0204182 (85.71%), and Class0204183 (83.33%) in 2020/2021. |

The performance criteria was met by 7 classes in 3 academic years: Class0204161 (84.62%), Class0204163 (80%) in 2018/2019, Class0204171 (96.42%), Class0204172 (94.73%), and Class0204173 (96.77%) in 2019/2020, and Class0204182 (85.71%) and Class0204183 (83.33%) in 2020/2021.

We didn't achieve the goal for Class0204162 (69.99%) in 2018/2019, and Class0204181 (75.61%) in 2020/2021. |

We made significant improvement in 2019/2020, as all the 3 classed achieved over 90% comparing with the perforance results in 2018/2019. But we faced a decline in 2020/2021 academic year,as Class0204181 achieved 75.61%, slightly below the goal.

We adopted the method of analyze the real Financial Statements of the listed companies, for the purpose to improve students' ability to use analytical and critical thinking skills to evaluate countermeasures and solutions. And we will maintain this method. |

|

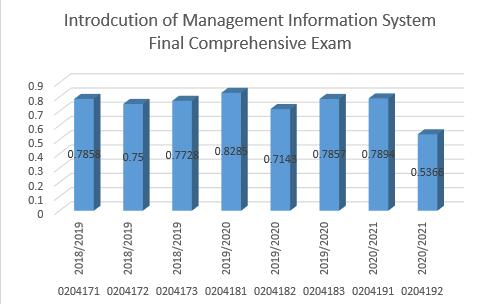

SLO5 - Students will demonstrate their ability to use data processing software such as Excel, SPSS to make business and economic decisions.

Goal - At least 70% of student enrolled in Introduction of Management Information System courses in the Financial Management program are scoring at or above qualified level on the final comprehensive exam.

100-point scale used: Exemplary(90-100), Superior(80-90), Proficient(70-80), Qualified(60-70) and Inadequate(below 60). |

Direct, Summative, Internal |

Data of 8 classes of Financial Mangement Program were collected for 3 academic years: 2018/2019, 2019/2020, 2020/2021 following

our accreditation process.

The performance goal were as follows:

Class0204171 (78.58%), Class0204172 (75%) and Class0204173 (77.28%) in 2018/2019.

Class0204181 (82.85%), Class0204182 (71.43%), and Class0204183 (78.57%) in 2019/2020.

Class0204191 (78.94%) and Class0204192 (53.66%) in 2020/2021. |

The performance goal was met by 7 classes in 3 academic years: Class0204171 (78.58%), Class0204172 (75%) and Class0204173 (77.28%) in 2018/2019, Class0204181 (82.85%), Class0204182 (71.43%), and Class0204183 (78.57%) in 2019/2020, and Class0204191 (78.94%) in 2020/2021.

We didn't achieve the goal for Class0204192 (53.66%) in 2020/2021. |

We made improvement in 2019/2020, as the results were improved comparing with the perforance results in 2018/2019. But we faced a huge decline in 2020/2021 as Class0204192 achieved only 53.66%, far below the goal of 70%.

We decided to allocate budget to purchase the license of advanced MIS training software for the training and education We considered it an effective way to improve students' skill in the real business environment. |

|

SLO6 - Students will demonstrate the ability to use statistical analysis software to analyze data and discover patterns to inform management decisions.

Performance Criteria - At least 60% of student enrolled in Finance and Economic Practical Writing courses in the Financial Management program are scoring at or above proficient level on the Financial Analysis Report Writing.

100-point scale used: Exemplary(90-100), Superior(80-90), Proficient(70-80), Qualified(60-70) and Inadequate(below 60). |

Direct, Summative, Internal |

Data were collected for 3 academic years following our accreditation process. The performance goal was met in all 3 academic years: 2018/2019, 2019/2020 and 2020/2021. |

We met the criteria in all 3 academic years, though the performance declined in 2019/2020 and 2020/2021 academic year. We achieved 96.77% in 2028/2019, 64.93% in 2019/2020 and 61.82% in 2020/2021. |

We changed the method of instruction in 2019/2020 academic year. We improved the requirements of using statistical analysis software to perform quantative analysis, which was a required essential content of financial ayalysis report. Though the result of performance declined in 2019/2020 and 2020/2021, we believed this was more effective to improve students' ability to use statistical analysis software to analyze data. |

|

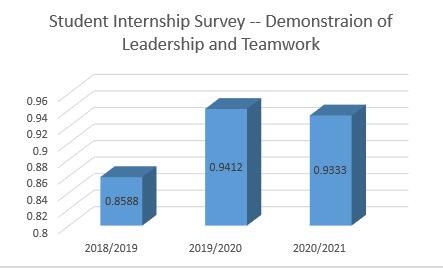

SLO7- Students will demonstrate their ability to communicate effectively with industry peers and the public on issues in the financial management field.

Performance Criteria - At least 80% of student enrolled in Financial Management program are satisfied with the team building and leadership development.

Student Internship Survey: Demonstration effective teamwork and leadership. |

Indirect, Summative, External |

We conducted the Student Internship Survey for 3 consecutive years following our accreditation process. Data were collected and survey reports were reviewed and discussed.

We achieved the goal for the 3 academic years: 2018/2019, 2019/2020 and 2020/2021. |

We met the criteria in the 3 cycle academic years, and made steady progress from 85.88% (2018/2019), 94.12% (2019/2020) to 93.33% (2020/2021). |

We hope to maintain the performance. Date suggested that students deemed "very successful" in the survey made steady improvement as well, as the figure increased from 4.53%, 5.88% and 17.14% in 2018/2019, 2019/2020 and 2020/2021 respectively. |

|

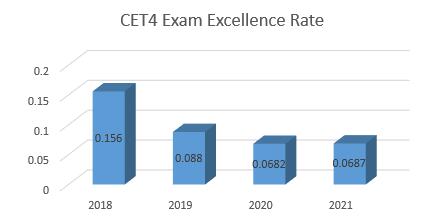

SLO8 -Student will demonstrate proficiency English language in listening, speaking, reading, and writing.

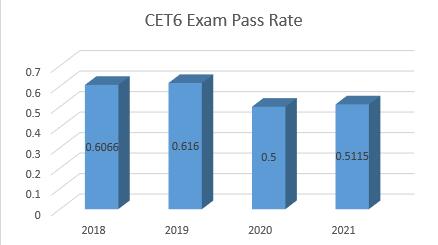

Performance Criteria - At least 5% of student achieved CET4 Exam Excellence Rate and 40% of student achieved CET6 Exam Pass Rate.

CET4 Exam: 5% Excellence Rate

CET6 Exam: 40% Pass Rate |

Direct, Summative, External, Comparative |

Data were collected for 4 consecutive years from 2018-2021 following our accrediation process. As CET is organized by the Ministry of Education, we collected data by calendar year.

We achieved the performance goal in each year. |

We met the performance criteria in 2018, 2019, 2020 and 2021, but the figure slightly declined each year. We achieved 15.60% in 2018, 8.80% in 2019, 6.82% in 2020 and only 6.87% in 2021. It suggested that we failed to improve our students' listening and writing skills in English. |

We encouraged the faculty to develop more bilingual courses. We hope to make progress and may increase our goal to 10% CET4 Excellence rate. |

|

| Direct, Summative, External, Comparative |

Data were collected for 4 consecutive years from 2018-2021 following our accrediation process. As CET is organized by the Ministry of Education, we collected data by calendar year.

We achieved the performance goal in each year. |

We met the performance criteria in 2018, 2019 2020 and 2021. We achieved 60.66% in 2018, 61.60% in 2019, 50% in 2020 and 51.15% in 2021. It suggested that we failed to make continuous improvement of our students' listening and writing skills in English. |

We encouraged the faculty to develop more bilingual courses. We hope to make progress and maitain our students' listening and writing skills in Englisn. |

|